Classic Equine SensorFlex Wool Top Pad (Merino) 32x34" (Grey/Navy) | 🤠 West4us.cz - Největší westernový obchod se značkami z USA! 🇺🇲

A'MAREE'S na Instagramu: „Now that you own an RV and are traveling around the United States, it makes sense to Glamp in the most luxurious way, wrapped in cashmere.…“

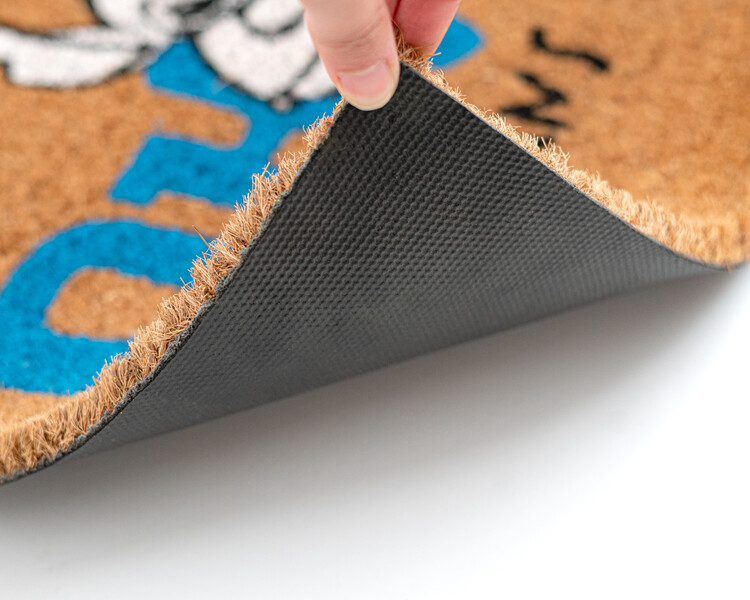

PIG – Univerzální absorpční rohožka HAM-O®: univerzální provedení, v kartonovém zásobníku, zelená | KAISER+KRAFT